Risk and Reward in the Stocks Market: What You Need to Know

Risk and Reward in the Stocks Market: What You Need to Know

The Risk and Reward of Investing in the Stock Market

Introduction

The stock market can be an overwhelming place to enter for the first time investor. There are many different types of investments and fees, as well as the potential to make or lose a lot of money. As with any investment, it is important to understand the risks and rewards associated with participating in the stock market. This article will provide an overview of the stock market, define risk and reward, and discuss strategies for managing risk.

Overview of the Stock Market

The stock market is a public marketplace for buying, selling, and holding shares of publicly traded companies. It is the central place where investors, both large and small, can purchase or sell ownership stakes in different public companies. The stock market presents investors with the opportunity to purchase stock at a certain price and, if the value of the stock increases, sell at a higher price for a profit. In addition, due to its sheer size, there are also diversification opportunities available in the stock market.

Definition of Risk and Reward

Risk is an inherent part of investing in the stock market because the price of stocks fluctuates at any given time. The potential reward of investing in the stock market is twofold: potential high returns, and the potential to diversify one’s portfolio. Therefore, the reward of investing in the stock market is weighed against the risk associated with it.

Types of Risk in the Stock Market

There are three primary types of risks associated with investing in the stock market: systematic risk, unsystematic risk, and volatility risk. Systematic risk is the risk associated with the entire stock market, as opposed to an individual stock. This type of risk is caused by events that affect the market as a whole, such as news events or changes in government policy. Unsystematic risk is the risk associated with a particular stock, such as a company’s performance or how it is managed. Volatility risk is the risk that the price of a stock may be suddenly affected by outside events or news.

Rewards of Investing in the Stock Market

There are several rewards associated with investing in the stock market, including potentially high returns, diversification, and tax benefits. Investors have the potential to make a high return on their investment if the value of the stock increases. Additionally, by investing in multiple stocks, investors can diversify their portfolio, meaning they have a greater chance of making money over the long term. Finally, tax benefits are available, such as capital gains, which is a tax applied when an investor sells a stock for more than what he or she paid for it.

Strategies for Managing Risk in the Stock Market

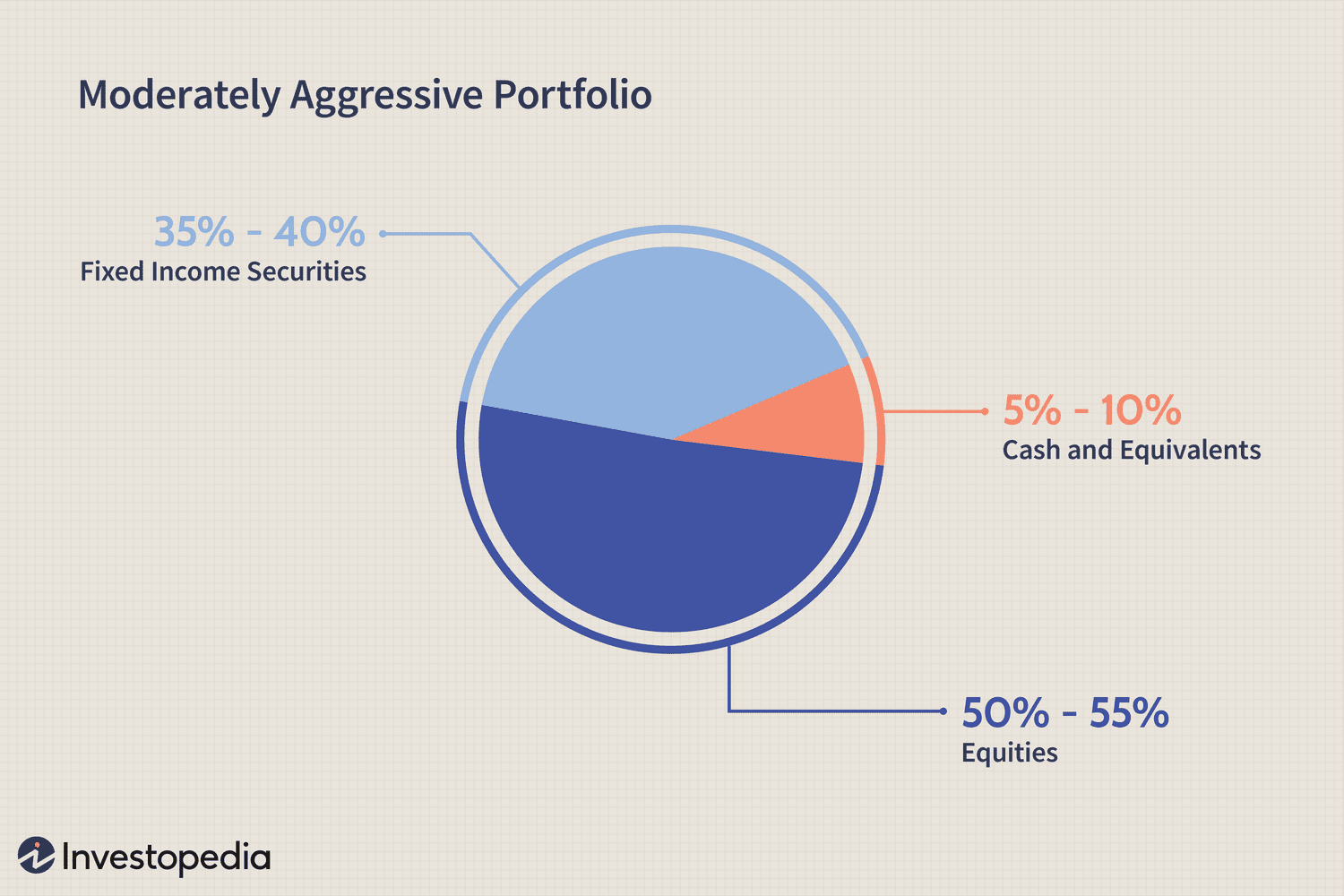

There are several strategies that an investor can use to manage the risks associated with investing in the stock market. Asset allocation is the practice of investing in a variety of asset classes, such as stocks, bonds, and cash, in order to distribute risk and maximize returns. Leverage involves borrowing money to purchase stocks and using the purchased stocks as collateral for the loan. This can be risky, as the investor may be responsible for paying the loan even if the stock loses value. Finally, investing for the long term can help reduce the risk associated with stock market investing, as stock prices tend to move in cycles and can be volatile in the short term.

Conclusion

The stock market is a complex and ever-changing marketplace, and so it is important to understand the risks and rewards associated with participating in it. By understanding the three types of risks and the strategies for managing them, an investor can make informed decisions about where to invest their money and have a greater chance of earning high returns.

Additionally, the potential rewards of investing in the stock market, such as potentially high returns and tax benefits, can be appealing for both short-term and long-term investments.

Risk and reward in the stock market is a concept that all investors should understand. Investing in stocks can be extremely rewarding, but it is also a risky venture. Before you invest, you should be familiar with the risks associated with stocks and the rewards that are possible. First, it is important to understand that stock markets are highly volatile. Prices can go up and down quickly and unexpectedly.

This volatility can be both a blessing and a curse. While volatility can lead to potential rewards for investors, it can also lead to serious losses. It is important to understand your risk profile and make sure that any investment decisions are in line with it. Second, it is important to understand the reward potential of stocks.

This means understanding the potential for dividend income, capital appreciation, and stock options. Many stock investors use a strategy called “buy and hold”, where they purchase stocks with the intention to hold them for the long-term. This allows investors to benefit from dividend income and the possibility of a significant increase in stock price over the long-term. Third, it is important to understand stock options. Stock options allow investors to take a more speculative approach and hedge against market volatility. Investors can purchase put options, which allow them to sell stock at a certain price.

They can also purchase call options which allow them to purchase stock at a certain price. Finally, it is important to understand tax implications. Depending on where you live, your investment gains may be subject to taxes.

It is important to understand these rules and to structure your investments accordingly. Understanding risk and reward in the stock market is critical for any investor. You should always research the companies you are investing in and the risks associated with stock investment. With a little bit of knowledge and the right strategy, you can earn tremendous rewards from investing in stocks.